I don’t know about you, but I do find it harder to save money now than ever before. For the first 8 years of my working life, I had never saved a single cent. We live in a consumerist society whereby we are constantly being tempted with products and services, promising us a more fulfilling life, with many buying into the story of how materialism can brings us happiness. From driving luxurious cars like BMW to Audi being the epitome of success, to owning designer brands like Chanel and Hermes to showcase a woman’s high earning power. Like the saying goes, “fake it until you make it”, people are flaunting what they own materially to make themselves look good and feel good. More and more people are going into debt as a result. I was one of them and recovery was painful. The path to wealth accumulation is actually a stimulation of simple steps, attainable by most.

So how does one accumulate wealth the sure but steady way?

1) Track and cut down on expenses

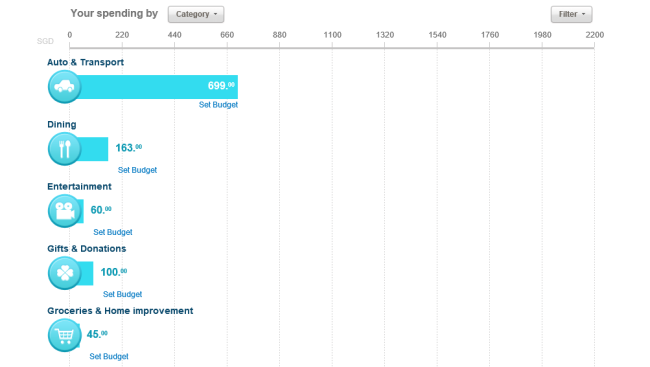

I used to wonder where all my money went at the end of the month, leaving me pretty penniless and having to live on credit. Tracking of expenses helps to add up my individual expenses to see where my money went exactly, and I was surprised at how much money I spent and how much the small stuff can really adds up. For example, I used to buy dresses from online shops thinking it’s just $30 for one dress and before I knew it, I spent over $600 on shopping just for one month. If you’re like me and are constantly wondering if there’s a silent thief quietly stealing all your money away, you better start tracking your expenses. You’ll be surprised at how much you spent on eating out, on a months’ worth of Starbucks coffee, or on taking cabs each month.

2) Develop a budget and stick to it

After tracking your expenses for a month or two, spending patterns should emerge and you now have a clearer picture on where your money goes to each month. Categorize spendings into different types of expenses incurred. Start recording your monthly income.

Salary – Expenses = Savings

I know you’re probably laughing at this simple equation. But how many of us are fully aware that having wealth starts from the leftovers from our earnings? Start looking on where you can cut back on and trim accordingly. The greater the balance is, the more money you are able to save. Many people yawn at the thought of following a budget but every business and corporation has a finance department and a budget in place for very good reasons. After tracking my expenses and sticking to a budget for a few months, my savings actually start to grow and I realized it’s actually possible to accumulate wealth. It just requires discipline and sacrifices.

3) Automate your savings by paying yourself first

The very first thing I do when I get my salary is to transfer a portion of it into a separate (untouchable) saving account. After a few months of sticking to a budget, you should be comfortable enough to know how much you need to set aside for living expenditures. However, do remember to budget for adhoc/ surprise expenses like birthday gifts for friends and family members, for festive seasons, renewal of yearly health insurance, provision for yearly vacations etc. This is to avoid digging into your savings/ emergency funds when these situation arises.

4) Earn more

There’s only so much you can cut back on, but there’s literally no limit on how much you can earn. (Stop complaining, you can always get a part time job if you are too poor to save money after covering basic necessities.) Over a one year period, I have optimized on cutting down on unnecessary expenses and am saving exactly 20% of my monthly salary. However 20% is just the bare minimum on how much we should be saving, and I’m working on maximizing my earnings. I aim to complete my ACCA by the end of this year, and the qualification has the potential to earn me a higher salary and a brighter job prospect, If your company is giving you a 3% increment every year and you’ve been with the company for over 5 years, then it’s probably time to ask for a promotion or seek greener pastures. Always upgrade yourself and learn whenever the opportunity arises.

5) Widen the gap

Aim to widen the gap between your income and expenses. The bigger the gap is, the greater and faster your savings accumulate. Avoid lifestyle inflation by not treating your salary increment and bonuses as an increase in spending power. While it is important to reward yourself (by spoiling yourself to something you’ve always wanted using the first month’s increment, or a small part of your bonus), do treat the increase in salary as a chance to save more. Or rather, ignore the increment and spend as budgeted, as though you did not get a raise at all.

6) Stop comparing with others

There will always be people driving fancier cars, owning more designer bags or living a more glamorous lifestyle. They may be earning more, have lesser commitments, or simply just come from rich families. Life is unfair that way. Comparing in term of owning material goods get you nowhere close to having a million dollar anytime soon. Prioritized and understand what is important to you. Is having a comfortable retirement and not having to worry about your child’s education more important than owning countless Hermes bags?

7) Avoid debt

I never get to save money when I was in debt. Simple reason being interest and late charges always eat into the little savings that I had. Being in a 18k debt means a couple of hundreds of dollars flushed down the drain (and into the banks’ pockets) every month. Now I avoid new debt at all cost and pay my credit card bills on time every single month. If I find myself thinking of breaking up my next purchases into installments, it means I just can’t afford it.

8) Invest regularly and prudently

Saving money is great. But remember banks pay you peanut interest of between 0.05% to 1% (for the case of fixed deposit) for parking your money with them. Once you have built up your emergency fund (I’ll talk about emergency funds in another blog post), invest the excess cash to earn more than the pathetic interest from banks and slowly accumulate/ reinvest to generate passive income for retirement. Don’t know what to invest in? While I’m no investment expert, I do recommend buying ETFs (exchange trades funds) to gain access to a pool of underlying assets for diversification which earns a dividend return of 2-3% annually. Instead of buying blue chips, the STI ETF pools together investors’ resources to dabble in a mixture of blue chips like the major banks in Singapore (DBS, UOB, OCBC), Singtel, Starhub, Keppel Corp, Jardin, Sembcorp, Capitaland, Olam, Noble etc. This ETF is also a close reflection of how the Singapore economy is performing.

So there you go. These steps worked for me, and I hope they work for you too 🙂